Introduction

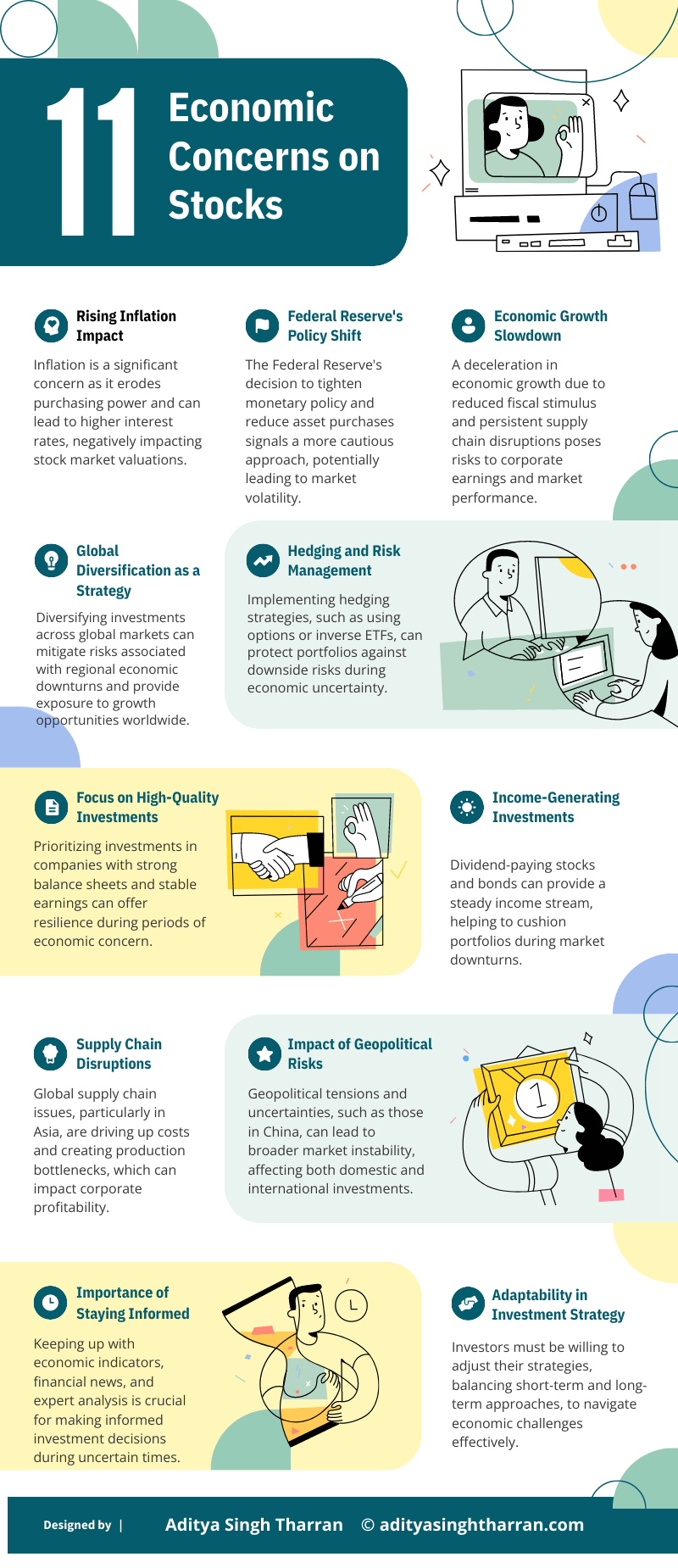

The financial markets have always been characterized by fluctuations in the value of securities, financial assets, and other such items but the recent economic concerns have mainly focused on fluctuations in stocks. Those investors who have experienced splendid growth in the previous year are beginning to have qualms as more problems begin to surface. These of factors are just among the many that have started to exert pressure on the stock markets as more economies transit to instability, inflation, and a change of fiscal policies. In this post let’s decipher how these economic concerns affect the equity markets and what might be expected in the future as well as how to approach the market in this volatile climate.

Table of Contents

Analyzing the Modern Macro Environment

The current global economy is perspective, yet it is associated with a myriad of challenges that continue to affect the stock markets in the world. This has been occasioned by perceived hawkish signals from the Federal Reserve together with a rise in inflation and a deceleration in economic growth. While all these economic concerns have been there for a while, their impacts on stocks have intensified as shown here.

1. Measures to indicate that the Federal Reserve is tightening its monetary policy

This makes the Federal Reserve’s signal of its plan to soon tighten monetary policy one of the biggest economic factors that affect stocks. This shift even entails a reduction in asset purchases which have boosted the stock market since the beginning of the COVID-19 pandemic.

- Impact on Stock Prices: It has been established that as the Fed reduced its monetary stimulus, stocks have their bearish pressures applied to them. It may be the case that asset purchases will decrease, which may cause an increased interest rate and thus higher costs to borrow for corporates and hence lower their profits.

- Investor Sentiment: The initial enthusiasm of the market when the Federal Reserve made the announcement has diminished, and hence one finds large-scale indexes such as the S&P 500 falling.

2. Inflation Concerns

Also, inflation has become a chronic problem, and the prices for goods and services have not ceased to increase, as well as the price for labor. Though, in an earlier period, the Federal Reserve could diminish inflation as a temporary outcome of the lockdown, it appears to be more extended now.

- Erosion of Purchasing Power: With increase in inflation levels, the level of buying power reduces hence there is a decline in expenditure hence slow economic growth.

- Pressure on Corporate Margins: The price of inputs such as food and human resource are increasing thus the possibility of lowering the operating margin and earnings.

3. Slowing Economic Growth

There is more negativity about economic issues that affects stock such as a slow growth in the economy. The source of enormous fiscal stimulus that agencies global delivered has started out to diminish, as with the financial uplift it made available.

- End of Fiscal Stimulus: In its recent budgets, the government tends to cut back its expenditure and probably this is likely to slow down the economy’s growth rate which in turn affects the corporate returns.

Sector-Specific Challenges: There are specific industries that could be more sensitive to a decrease, notably industrials and semiconductors, especially these that received main boosts from fiscal incentives throughout the pandemic.

The Significance of Economic Interest In Various Fields

The impact of these economic concerns is not the same for every sub-sector of the market stock. Although there are a number of potential problems, some industries can be less affected than others, depending on the level of impact of the described risks.

1. Technology Sector

The technology sector has been one of the most significant sources of stock market returns in the past decade, but it comes face to face with several challenges.

- Valuation Concerns: Some of the technology companies use growth rates to estimate the value of their firms and, thus, are vulnerable to the changes in interest rates and the rate of economic growth.

- Supply Chain Disruptions: This has strangled the global supply chain and also impacted industries like technology due to a shortage of components used labelled as semiconductors.

2. Financial Sector

Another field that is heavily connected to the economic perspectives about stakes is the financial industry.

- Interest Rate Sensitivity: Usually banks and other financial institutions can gain, for instance, from the increase in interest rates as they can raise the interest rates on loans. However, if there are issues in economic growth then the demand for loans will reduce.

- Inflation Impact: For financial stocks, inflation is a two-edged sword. Although higher prices cause demand for credit, they have also negative effects as they reduce the value of investments.

3. Consumer Discretionary Sector

The consumer discretionary area can be namely the industries related to retail, travel, and others, and is very affected by the consumer’s activity and characteristics.

- Reduced Consumer Spending: Due to inflation; the general purchasing power of people is reduced less money will be spent on other goods and services therefore recessing revenues firms in these industries.

- Economic Uncertainty: Such instability may reduce expenditure and increase savings, hence a negative effect on this sector in the long run.

Also Read:

Measures that can be taken regarding Economic Worries That Might Impact Stocks

Because of the emerging frequent issues with the stocks’ performances in the market, investors have to be more wise in their investment processes. Here are some strategies that can help navigate these challenging times: Here are some strategies that can help navigate these challenging times:

1. Diversification

Nowadays, it is quite risky to invest in a single company because of so much fluctuation, but the best way to escape risks is through diversification. To reduce the level of vulnerability in any particular risk the investor always diversifies in various classes, business sectors, and regions.

- Global Diversification: Buying international stocks can help diversify the portfolio away from domestic factors that harm it.

- Sector Diversification: Diversifying the investments in the different fields is one of the tactics for minimizing the effects of the slowdown in the economy in certain sectors.

2. Focus on Quality

When you are in a state of confusion, markets with quality stocks, those holding unbroken earnings, good balance sheets, and sound business models have better performance than risky stocks.

- Blue-Chip Stocks: Such large and well-established organizations are usually in a better position to manage volatility in the business cycle.

Dividend-Paying Stocks: To expand, companies that can pay dividends on a say, monthly or quarterly basis means investors could get a fixed amount of returns, especially in an unstable market.

Global Economic Worries and Their Effects on Stocks in the Long-run

Sector Analysis: Which Industries Are at Greatest Risk?

While the investors take hold of quotes’ efficiency in response to economic conjectures – it is equally momentous to signify the endurable results. These worries are not mere fleeting noises in the market – they are capable of defining investment trends for many years. Below are some of the long-term factors that may affect the stock market and investment:

1. Changes in the structure of the economy

Most economic anxieties about stocks are real concerns about structural shifts in the economy. Such changes may shift the mode of production, the economic activities that act as the growth engines, and at times, the overall economic structure.

- Shift to a Digital Economy: COVID-19 has reinforced the requests placed on digitization as businesses more and more rely on tech for growth. The shift here should be expected to persist and it shall result in technology becoming one of the lasting fundamental influences of market conditions, in the long run, irrespective of the short-term problems that would manifest from the cycles of the economy.

- Global Supply Chain Realignment: Global disruptions such as the pandemic and geopolitical tensions have made organizations start questioning their supply chain practices. It could result in more long-term costs in the short run but can lead to the development of better and more sustainable business models.

2. Inflation and Its Economic Consequences

Inflation may, at the moment, be a subject of much focus in the economy, but its impact on stocks could even be more profound in the long run. Therefore, inflation in the increased range for an extended period can change consumers’ behavior or affect profits and ultimately monetary policy.

- Persistent Inflation: Should inflation remain elevated, central banks may again have to increase interest rates consequently hurting growth rates and declining corporate profits: This kind of situation could lead to a state of the market that is not stable for a long time.

- Wage-Price Spiral: When wages rise consequently on shortages of labor, a cumulative process may arise of building up inflation through wage-push, where an increase in wages creates an increase in prices. Such a situation may prove to be rather unfavorable for both the businesses operating and the ultimate customers.

3. Changing Investor Behavior

These economic constraints affect investment decisions and more so the stocks since people are likely to change their attitude and be extremely cautious when the climate is throwing more risks than usual. The changes that are experienced here in the short run may have ramifications on the market forces in the future.

- Increased Focus on Risk Management: Consumers may cut their spending as they start to minimize their risk by buying safer instruments like bonds or gold as opposed to equities. It may decline the need for high-risk investments hence lower prices of speculative stocks may prevail.

- Growth of ESG Investing: Sustainable and Responsible investing popularly referred to as ESG has gained popularity in the market in recent years and the economic factors may provide further spur to this phenomenon. The rise in demand for sustainable investments makes clients search for shares of ESG-compliant businesses, which may mean higher multiples for the firms.

Wanted to know more: Visit New York Times

If there is a continuous focus on the economic values of stocks, then the exposure of some areas may be higher compared to others. Knowledge of these risks can assist investors who are willing to invest their money in a specific business to know where to put their investment.

1. Real Estate Sector

The real estate business can be affected by economic factors and in particular by rates of interest and inflation. Higher interest rates make borrowing difficult and costly thus decreasing the likelihood of property demand and possibly the prices.

- Impact on Residential Real Estate: An increase in the rates would see a slowing down of the housing market meaning consumers will struggle to afford the home. This could also dampen the demand for residential real estate hence pulling down prices for homes.

- Commercial Real Estate Challenges: The change of working from home has become more popular due to the outbreak of COVID-19 and thus a reduction in the demand for office space. When the companies remain committed to remote and the versatility of work schemes, the CRE industry may encounter some more problems.

2. Consumer Staples Sector

Despite the consumer staples being regarded as defensive, the sector is not fully insulated from economic factors as far as stocks are concerned. Hypertension negates the purchasing power of consumers hence a decline in the demand for unessential products.

- Rising Costs: The cost pressure in the consumer staples sector is a rising concern as there is an increase in the prices of the basic input which includes the raw materials, transportation, and wages. However, some of these costs can be recovered from consumers in what they call layer cast that is there is a limit to how much he can increase the prices of its products without affecting the demand.

- Changing Consumer Preferences: Fluctuations in business cycles may force consumers to purchase only the necessities because they cannot afford luxuries thereby changing the demand pattern for the consumer staples.

3. Energy Sector

The energy sector has a lot of connections with economic issues such as inflation, geopolitical issues, and other issues regarding the change in consumer demand.

- Volatile Energy Prices: Historically the energy sector has never been isolated from fluctuating prices but what seems to be worsening the situation is some economic factors. Inflation increases and unstable relations with other countries also contribute to instabilities in energy costs, which affects the strategic planning of these companies.

- Shift to Renewable Energy: Now, the shift from non-renewable source of energy is on the rise due to awareness about the effects on the environment and the profitability associated with it. This shift may pose problems to the classic energy organizations especially those oriented towards the usage of fossil fuels.

Economic Concerns on Stocks: Interpreted and Estimated Views of Specialist

For a better understanding of the opportunities for economic concerns to affect the stocks, it will be pertinent to look at the possibility with experts in economic affairs. In the following section, here are the leading economists’, market analysts’, and investment professionals’ views.

1. Expectations of Inflation and Interest Rates as Perceived by Economists

Prices and inflation as well as interest rates have remained important determinants of the stock market’s performance as has been observed by economists.

- Inflation Predictions: Most economists expect that inflation will be high in the short term due to the disruptions of the supply chain, increased shortages of labor, and higher costs of commodities. However, there is no such agreement relating to the extent of continuing inflation for the longer term.

- Interest Rate Outlook: One of the areas that will attract much attention in the next few months is the Federal Reserve’s stance on the management of interest rates. There are forecasts which state that the Fed will increase the rates much more frequently if inflation remains high; there are those who think that the central bank will pull back gradually to prevent the growth of the economy from being slowed down.

2. Experts in the Analysis of Sectors and Markets

Economic conditions affecting stocks have been described in how various industries might do so and so by market analysts.

- Technology Sector: While some of the analysts are bearish on the space due to the valuations and the problematics of supply chains, some others argue that the good times are also the new normal for the technology space. Leveraging the current market situation may well be the key determinism, and companies that can keep competing after applying counterparts may.

- Financial Sector: The overall opinion of the analysts is rather buoyant regarding the financial sector, especially when the interest rates are on an upward trend. Higher rates could mean higher profits for the banking firms and other institutions dealing with the provision of funds. But this may be neutralized by a lower growth rate which always affects the economy.

3. Investment Professionals dealing with Risk Management

While the economic issues are ruling the market, the investment professionals working as financial advisors are guiding the clients on how to mitigate risk.

- Diversification Strategies: The majority of investment gurus have most of the time ‘cried out’ the four letters and two words of Greek –diversify- as the best part of valor in a bid to minimize risks. Portfolio diversification of different classes of securities and sectors minimizes the investor-connected risk to a particular economic issue.

- Focus on Quality: In the period of fluctuation, the experts emphasize that one has to invest in shares that have several presuppositions. Financially secure organizations, that generate consistent earnings, and those who enjoy a wealth of competitive advantage are likely to be less vulnerable to fluctuations in economic activity.

Most importantly, recommendations on how to position your portfolio concerning existing economic factors

As a result of the new economic issues, regarding stocks investors require new information to define the right portfolio. Here are some doable actions to think about: Here are some thinking-action steps to consider:

1. Rebalance Your Portfolio

To be able to make certain that your balance is as per your investing goal as well as risk tolerance you need portfolio rebalancing.

- Review Your Asset Allocation: When conducting holdings evaluation a special emphasis should be placed on the current asset allocation and whether it has the right strategy. A great amount of equities within the portfolio might require the introduction of bonds or any other fixed-income securities to moderate the level of risk.

- Consider Sector Rotation: Sector rotation is all about moving from one sector to another of investment since one is more endowed with economic power as compared to the other. For instance, if you believe an economy is bearish, you may choose to allocate your money to factors that flourish in the bear economy such as oil or finance.

2. Focus on Defensive Stocks

Circuit stocks can be described as those stocks that are seen to be stable during issues or economically unstable times. This means that such stocks are usually in specialties for example the health sector, the utility sector, and the consumer staple goods sector.

- Healthcare Stocks: This sector is normally less cyclical since people’s demand for healthcare has little consideration of the current economic climate.

- Utility Stocks: These tend to be the utility type of companies, which include the providers of electricity or water, which are among those businesses that are never likely to be out of business no matter how harsh the economic times are.

3. Keep a watch on the valuations

Evaluations significantly contribute to understanding the profit-making opportunities of an investment. Given that it is present in a century that is mostly focused on aspects of the stock market economy, one needs to be particularly careful with the issue of valuation.

- Avoid Overvalued Stocks: The shares that look expensive based on P/E multiple or possible growth may sell off more easily in bear markets.

- Look for Value Opportunities: On the other hand, low stocks may be looked at as good investment opportunities, especially if the stocks belong to well-established companies with the possibility of upward growth in the future.

Sophisticated Portfolio Management about Issues on Stock Given Economic Worries

If the recent economic climate is anything to judge by there may be cause for concern about stocks, thus traditional investment strategies may not suffice to keep the portfolio both secure and growing. For those investors who start acquiring their investments, experienced plays may well provide a potent defense. These strategies are usually accompanied by a prefatory analysis of market trends, shifting toward ‘non-traditional’ financial investments, as well as concern for risks and opportunities.

1. Hedging Against Market Volatility

Hedging is an advanced technique in which an investor uses positions in the market that are intended to serve as a protective counterbalance to the risk that is present in another segment of the portfolio. This approach is very effective in periods with high economic concern with stocks to bear serious losses in case of a slump.

2. Incorporating Alternative Assets

Alternative assets should therefore be used to diversify risk and hedge against the stock and bond markets which have remained dominant in most portfolios. These assets tend to have performance characteristics that are different from those of equities and this can be a boon during economic worry.

- Real Estate: It is also used as an inflation hedge because the price of property and rental income will usually increase in the inflation rate. Real estate investment trusts or REITs are a form of investment in the real estate sector that does not necessarily require the management of physical estate hence giving the investment liquidity and access.

- Commodities: Precious metals such as gold, silver, and oil normally exhibit positive inflation hedges as they are used to hedge during inflation. This is the case with gold which is viewed as a haven and as such investors’ demand for it causes its price to up.

- Private Equity and Venture Capital: Private equity as well as venture capital allows investors with a relatively higher risk appetite to invest in firms that are not publicly held. Such investments are sure to yield good returns, but they are also risky as well as long-term investments most of the time.

3. Exploring Global Diversification

Internationalization implies the distribution of commitment in different parts of the globe to diversify the risk and possibly superintend the returns. Expanding internationally investors are in a position to harness growing markets in different locations as well as at the same time avoid the effects that certain economic issues may have on the stocks of any particular country.

- Emerging Markets: The advantage of these markets is that they allow higher growth rates as opposed to developed markets; however, the risks are much higher. These markets can have a positive demographic profile, a high and still growing rate of economic development, and growing consumer demand. But again, they are more vulnerable to political instabilities and economic fluctuations than the developed countries.

- Developed Markets: Having operations in developed nations for instance Europe or Japan helps because the markets are fairly already set. These markets are normally less risky than the emerging markets but their growth prospects might be lesser.

- Currency Diversification: While investing in another country, there is such a thing as currency risk that must be taken into account. This situation implies that there can be losses out of the buying of foreign investments because the worth can change due to shifts in currencies. To manage this risk one can utilize currency-hedged ETFs or invest in more fixed currency-centered assets.

4. Tactical Asset Allocation

Tactical asset allocation is a sophisticated approach to portfolio management that includes changing the allocation of assets as a result of the current trends in the market or the expectations of economic performance. While strategy requires a long investment plan, tactical asset allocation is more dynamic and can be adjusted to the current issues’ volatility.

- Dynamic Adjustments: As economic concerns and quarterly or annual results on stocks draw the market, tactical asset allocation in a way gives investors the ability to either add or trim their exposure to specific asset classes, sectors, or regions depending on the forecast. For instance, expectations of increased inflation can be dealt with by investing more in inflation-indexed securities or buying commodities.

- Short-Term Opportunities: This strategy also allows the investors to exploit any short-term points of inefficiency or inconsistency in the market. However, there are need for market analysis and a fast response to changes in consumer demand.

5. Income-Generating Strategies

Income-producing strategies stabilize the income from investments or services, which is particularly useful when the economy is unstable. It also applied to the use of dividend-yielding equities, fixed-income securities, and other related instruments.

- Dividend Growth Investing: A dividend growth investment strategy can be referred to as the process of identifying and investing in shares holding with a record of paying an increasing dividend. The authors therefore affirmed that minded firms that boast a healthy cash flow and which stick adequately to the policy of returning cash to their owners are likely to offer better resistance during recessions.

- High-Yield Bonds: High-yield bonds or junk bonds provide higher interest returns relative to investment-grade bonds because of their risk status. They do offer quite desirable incomes, yet risky with more susceptibility to the economic crisis and defaulted payment.

- Covered Call Writing: It is one of the option basics in that it involves selling calls on stocks you own but plan to hold for the long term. This may times create more revenue from the received premiums but it also has a downside of capping the maximum that can be earned with the stock.

Evaluation of Some of the Central Banks and Government Policies

Government and central bank policies have significant impacts on the economy and as a result, resonate on stock markets. Knowledge about them enables investors to analyze market trends about these policies and thus invest accordingly.

1. Monetary policy involves the manipulation of the supply of money and available credit into the economy through control of interest rates.

Monetary policy involves the control of money supply and is usually conducted by central monetary authorities for example the Federal Reserve Bank. Fluctuations in rates of interest are, perhaps, one of the most effective instruments in their arsenal since they directly bear an impact on issues of economic interest on stocks.

- Raising Interest Rates: Lenders’ funds become expensive when interest rates are raised by central banks a situation which has ration effects on the economy through affecting corporate profits. Higher rates also depress the values of stocks as compared to bonds and other fixed-income securities thus causing a flight out of equities.

- Quantitative Easing (QE): Quantitative easing therefore is a monetary policy by which the central banks buy government securities and or other financial assets with the view of increasing the supply of money in the economy. There is evidence that QE can improve the stock market by reducing the interest rates and the money base but does encourage inflation and asset bubbles.

- Stimulus Packages: Government relief programs including the stimulus packages especially in the period of COVID-19 enhanced the spending levels of consumers and supported business entities. However, these measures can also result in large budgetary deficits and other macroeconomic problems in the long run.

- Tax Policies: Adjustments in the tax laws including the likes of the corporate tax, capital gains tax, and others alike can sway the actions of investors and even the profitability of the existing corporation. That is, for instance, corporate taxation could lead to a reduction in earnings while friendly policies towards taxation could goad investment and expansion.

Regulatory Environment

One more factor that can impact economic considerations on stocks is the existence and qualities of the regulatory authority. Fluctuations in the regulation can open up prospects for one or another sector or become threats to one or another type of business.

- Financial Regulation: A substantial increase in the financial regulation standard can reduce the operations of banks and other financial institutions, which affects incomes. On the other hand, deregulation may enhance the chances for growth and development to happen in the various Industries.

- Environmental Regulations: Due to the enhanced consciousness on environmental matters the authorities have put in place strict environmental standards. Even though often such regulations pose threats to some industries like energy and manufacturing, there are always opportunities that come with them for those businesses that invest in the green environment and innovative green technology.

Staying informed and adapting or flexible is another of the research findings of the study

But for the current fast-evolving economic environment, it is important to obtain knowledge and adjust your portfolios for managing economic matters on stock. For those willing and able to be more active and adapt to the changes then risk can be effectively managed and the opportunities gained.

1. Continuous Education

Market conditions, economic factors, and investment approaches, therefore, must be learned time and time over when it comes to decision-making. For guidance information from these roles, the use of financial news outlets, investment blogging, and economic reports would go a long way in providing the required information.

- Economic Indicators: Focus on the annual percentage change, the unemployment rates, and inflation rates to name but a few. Some of these indicators may hold information as to the status of the economy and possible movements in the market.

- Earnings Reports: Examining the earnings reports of the organizations in which you have invested can be a way to follow their performance. It will thus enlighten your decisions concerning investment because you will know what makes the earnings either grow or decline.

2. Consulting with Financial Advisors

When it comes to investment, FINANCIAL ADVISER is an expert that can provide customized advice on your financial goals and your capacity to deal with risk. Financial advisors can assist you in formulating your investment plan, to include considerations on matters touching on the stock market as influenced by the economy.

- Portfolio Reviews: Scheduling, portfolio meetings with your advisor will be important to check whether the portfolio is properly diversified and suits the current state of affairs.

- Tax-Efficient Strategies: A financial advisor can also help you with planning about its tax implication and how you can reduce your tax burden e. g by tax loss selling or how you structure your investment and trading accounts.

3. Staying Agile

Last but not least, it is important to note that risk management; that is remaining versatile in your investment style contributes to keeping a fixed game plan depending on the new information that might be received in the future. This is especially so given the current market environment, where economic considerations of stocks are rather paramount.

- Reassess Risk Tolerance: Anyone can have a heart attack, however, high-risk individuals need to periodically review their risk tolerance to adjust their portfolio as required. It is possible that in the future, based on market conditions and the change of 1 to another, you may be required to alter your position on the type of assets to invest in or asset proportion mix.

- Opportunistic Investing: Consider being potentially active in the portfolio, where you invest in companies based on the current conditions in the market. Although it is requisite for a deep analysis and perfect timing, it always results in great outcomes.

FAQs: Economic Concerns on Stocks

- What are the basic factors that affect the economy that in turn affect the stock market?

Some of the economic factors that affect the stock market include inflation levels which affect the worth of stocks, changes in interest rates which affect the company’s funds, deterioration in economic growth, political instabilities, and alterations in government policies. These factors can bring about the fluctuation of the market and harm corporate earnings.

- What particular measures shall I take to ensure that my investments do not suffer losses during economic difficulties?

To protect the investments during the adverse economic environment, it is relevant to apply hedging tools, including options and inverse ETFs, shifting to other types of assets, such as real estate and commodities, and paying much attention to income-generating stocks and bonds.

- It is however important to know that is it safe to invest in stocks during economic uncertainty.

In the end, economic instability does not mean that investing in stocks is a dangerous activity; it is safe when done in the right way and the right proportions. There are specific approaches that have to be taken: one has to concentrate on high-quality companies, several of which have to have sound balance sheets, and also to diversify internationally, and thirdly to act prudently according to conditions on the market.

- In what ways does international diversification enable the consonance of economic issues?

This is aided by diversification since the investments are made across countries and markets thus do not experience a burden from the economic problems of the country of investment. It enables the investors to access growth prospects in different regions of the globe and it also cuts down the chances of losing in a single region.

- Exploring the function that central banks undertake as regards the stock market.

Central banks impact the stock market mainly in the form of monetary policies including rates of interest and quantitative easing. These actions imply the borrowing costs, and inflation rate, and with a consequent effect on economic growth, which is reflected in the performance of share prices of stock.

- Amid economic concerns, should I be more strategic and concentrate on the short-term?

Although there are short-term approaches to capitalizing on market inefficiencies, long-term approaches are normally less risky and hold better return prospects. In many cases, it behooves an organization to have both a fixed long-term strategic direction as well as short-term contingencies.

- What are some of the ways of ensuring that one updates the knowledge of the state of economic conditions of the stock market?

Keeping abreast with the rest involves periodically going through economic signals, corporate results, and financial information. Other sources of information include reading through quality financial magazines and newspapers, following an analyst’s recommendations, and seeking advice from a financial planner.

- What factors must be understood to evaluate the investment risks in association with investing in other types of assets during financial instability?

Real estate, commodities, and private equity instruments are all good examples of non-traditional assets that can prove useful in diversification but involve the dangers of high illiquidity, high fluctuations, and even very high losses. They need to be sufficiently evaluated before going for an investment to avoid any shocks down the line.

- In what ways will the use of income-generating strategies be of value during recessionary episodes in my portfolio?

The other form of pillow investment is through income-oriented formulas, for instance; an investment in shares with regular dividends or bonds which will yield high returns. Such approaches can also give certain stability and postpone to some extent dependence on capital gains.

- If my desired level of risk has been affected in any way by these economic factors what should I do?

And when your tolerance to risk improves or decreases, it may not be such a bad idea to rebalance your portfolio and its offerings. Cultivating a behavior that is consistent with your current risk tolerance goes a long way in reducing stress and keeping your eye on the long term despite the prevailing economic climate.